8 Retirement Mistakes - and how to avoid them

Retirement is a phase of life most of us look forward to. It’s a chance to pursue other interests, travel and maybe do some part-time work or volunteering.

Thanks to more than 30 years of compulsory superannuation, we are also retiring with more savings than previous generations and have higher expectations of the lifestyle we wish to enjoy. But that also brings its challenges.

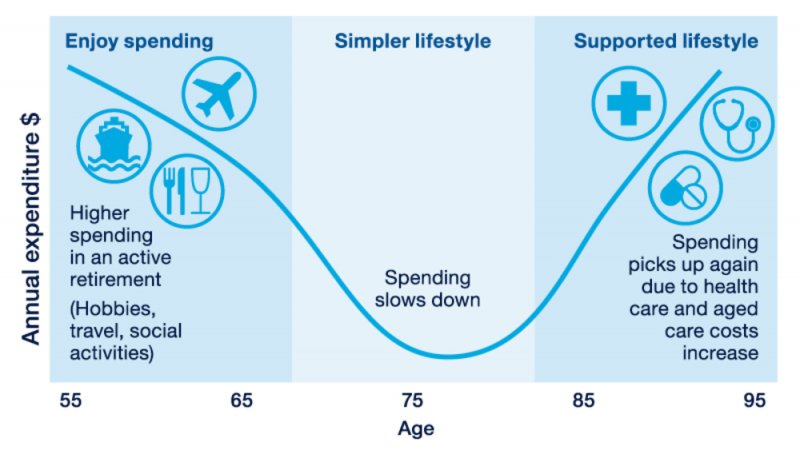

According to the government’s Retirement Income Review, the average age of retirement in Australia is around the ages of 62 to 65.i At the same time, today’s 65-year-old men and women can expect to live to 85 and 88 respectively, on average, and many will live well into their 90s.

To make the most of your retirement years, it’s important to have confidence that your savings will last the distance. The best way to achieve that is to have a plan that will help you avoid some common and preventable retirement mistakes.

Mistakes people make

While it’s impossible to predict what financial challenges lie ahead, these eight common retirement mistakes remain the same:

1. Not knowing your living costs

When you are receiving a regular income, you may be tempted to focus less on keeping a track of your living costs. When the regular income stops at retirement, you can be unaware of whether your investment income and/or pension payments will support your lifestyle costs.

Knowing what your living costs are before you retire can help manage expectations accordingly.

2. Not looking at your super until just before retiring

What if your super was invested in conservative assets throughout your working life? It could mean that your super would not have grown to the level needed to fund your retirement. What if your super’s insurance premiums and fees consumed the returns?

It is vital to review your super account as early and as regularly as possible to ensure it is appropriate for each stage of your life.

3. Underestimating the impact of inflation

Australia’s rate of inflation hovered around 1 per cent to 3 per cent per year between June 2012 and early 2020. Since the onset of the global pandemic in March 2020, inflation has jumped to more than 7 per cent.ii This along with a disruption to the global supply chain and the Russia-Ukraine war has lifted the cost of living to levels that require you to reassess your retirement planning.

4. Not understanding your government entitlements

If you’re age 66 or older, you may be eligible for a full- or part-Age Pension. However, even if your level of wealth puts you above the pension limits, you may still be eligible for other entitlements.

These can include the Seniors Card, Pensioner Concession Card, income tax offsets or pensioner stamp duty exemption/concession.

5. Letting the noise affect your investment decisions

Negative news grabs headlines, such as talk of billions being wiped off share markets, but you rarely read about the billions made during the rebound. There is no denying that the financial markets face volatility during periods of uncertainty. However, as history has shown, over the long run the market trends upwards.

All this noise makes it difficult to stick your long-term strategy, when in fact such events can present opportunities in the markets too.

6. Trying to time the financial markets

"We haven't the faintest idea what the stock market is gonna do when it opens on Monday — we never have," said legendary share investor Warren Buffett. Say you invested $10,000 in the ASX 200 index by trying to time the market and you missed the 40 best days between October 2003 to October 2022, your investment would be worth $9,064, whereas if you remained fully invested it would be worth $46,099.iii

Trying to time the markets is never a good idea, especially with your retirement savings.

7. Being asset rich and cash poor

You may have built up a strong balance sheet of assets, but in retirement it is income you require. For many Australians, their family home could be their biggest asset and its value is sometimes unlocked by downsizing into a smaller home, but many Australians remain living in a family home that has surged in value while they struggle to find enough income to live on.

Are your assets generating enough income to support your lifestyle? This income can include rent from an investment property, share dividends or managed fund distributions. If the income is insufficient, you may have to sell some of your assets to provide that liquidity or tap into the equity in your home by taking out a reverse mortgage-style loan.

8. Not consulting professionals

Financial advisers, accountants and other financial professionals can help set you on the right path by navigating the complexities of superannuation, investments, constant rule changes and other factors that affect your retirement. A good retirement plan, implemented correctly, can set you up for life.

Start Planning

Whether it’s due to lack of time or awareness, too many people tend to make these same mistakes when entering retirement which can lead to unwanted financial surprises.

A phase of life you have looked forward to for so long deserves careful planning. So please get in touch if you would like to review your retirement income needs.

i Retirement Income Review Final Report, July 2020 page 63 Retirement Income Review Final Report (treasury.gov.au)

iii From 31 Oct 2003 to 04 Oct 2022, Fidelity Australia Timing the market | Fidelity Australia